HODL – “Hold on for dear life”

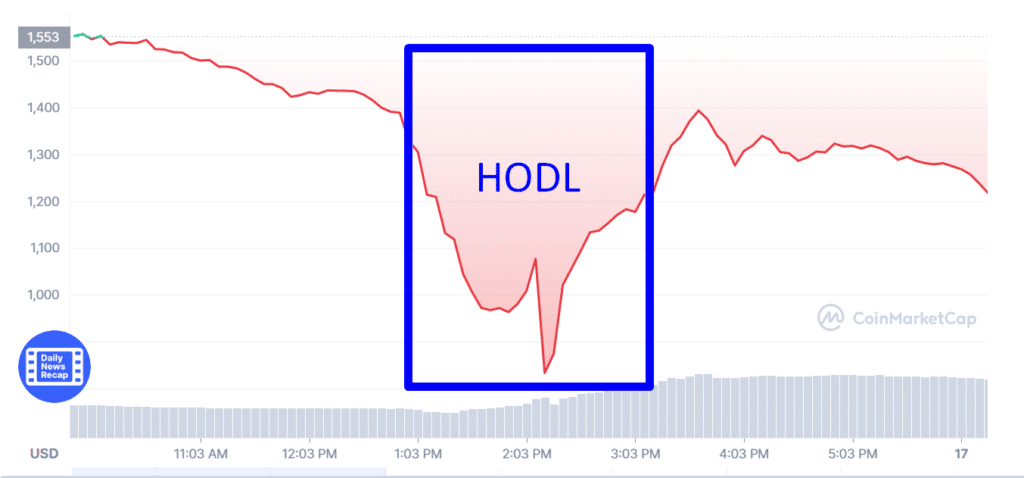

Watching crypto investments over the long term can be painful if you don’t have the stomach to handle the ups and downs.

It is really hard not to want to sell when an investment is on a losing streak. Sometimes it can bounce back quickly.

Creating a “roller coaster” effect of ups and downs when holding on for dear life makes a lot of sense.

I’ve heard many people talk about the “crypto crashes” that they hear about in the media. It’s not uncommon to see 20%+ swings, especially in the lower cap coins. But what many fail to realize is that while the price may be down significantly as of recently, if you zoom out a year or two the price is up significantly.

For example, the media was calling it “Crypto Winter” when ETH was down to $3,200 in early Janruary 2022.

If you took the time to zoom out you would have seen that a year ago ETH was only $1,200. Nearly 3x in one year. Not bad, but holding through those down turns is no doubt difficult.

This is where the HODL strategy comes to play.

Here are my long-term HODL strategy investments.

Coins that I put a little money in, stake if possible, and try not to look at (as much as possible) and hold on for dear life.

The below coins are coins that I hold some value of.

FlashLoans.com – FLASH

The flash token is a risky bet, but I love the concept of flash loans. At the time of writing their tool is still in the process of being launched, but the mock-ups look professional and could be a useful tool.

The FlashLoan.com token has some revenue-sharing opportunities, the owners are transparent, and the white paper is professional. This is one that I plan to hold and see where it goes.

Decentraland – MANA

I put a little money in early with this one, then when it doubled over a few months, I removed some of my profits to reinvest elsewhere. Of all the gaming coins, this one has a lot of traction and isn’t going anywhere soon. Investors are pouring money into buying land in Decentraland, and although still risky. I see this as a long term hold.

Enjin – ENJ

Enjin is a platform for developers to easily create NFTs. The most common example would be in gaming and virtual world ecosystems. It’s been a steady gainer, but also could easily go to zero. This investment is similar to Decentraland

PancakeSwap Reward Token – CAKE

I use CAKE to participate in their pool offerings to earn other coins as rewards. Many of the reward coins are long shots, but if I’m going to take risks, I prefer to do it with house money. If Cake goes up, it’s a win, and if the coins I’m staking earn a bit at the same time it’s another win.

Apeswap Rewards Token – Banana & Ghana

Similar to PancakeSwap with Banana you earn rewards by staking on ApeSwap. Most would recommend staking to earn the Banana rewards and then stake again to earn other token rewards. I’ve done a bit of this, but I also bought a little Banana when it was cheap to earn rewards on the ApeSwap platform.

Ring Financial – RING

Let’s just say I’m a little embarrassed about this purchase, but when I bought it, the project looked great. Lots of traction, great rewards, and a token model, that made a little sense. If I look back there were a few red flags I should have noticed, the most prominent being that all the owners of the project were anonymous. I would not recommend buying any as it’s been a straight downfall, and what was previously great communication has turned to essentially no communication from the project creators.

I included RING here as I wanted to be transparent in what I was buying and holding, not everything is a winner, and this is a great example. It should be noted this was a rug pull, and no longer a project.

Vapor Nodes – VPND

At the time of writing, this one is probably one of my favorites. It’s up nearly double from when I first invested. The team is very transparent with the treasury and governance. There have been a few instances with this project that raised some small red flags in terms of just being a “new” project, but overall I’m bullish. Unfortunately, this project looks a lot like Ring Financial which I mentioned above was a bit of a disaster, so proceed with caution.

Vapor is using a DAO how it should with community voting and transparency. You’ll find the Ring Army pushing the token on Twitter and an active discord group. If the traction keeps up, this one will be a true winner.

Whale Loans – HUMP

Whale.Loans is a fork of the OHM project. Another rebase style project, which depending on who you ask it’s either a scam or a stroke of brilliance. I fall somewhere in the middle. I feel that in a way it’s a bit of a pyramid scheme, but hey there have been some widely successful pyramid schemes that make some good money, just need to be sure to get in and out at the right times.

As of right now, I’m down a bit on my Whale loans investment, but I’m HODL and hoping this one turns into a winner in the long run.

Wonderland – TIME

One of the most popular rebase projects with a cult-like following. Time made a lot of people rich and lost a lot of people’s money as well. Knowing how to rebase projects work is extremely important if you are going to invest here.

There was a lot of Drama around TIME, and I would NOT recommend investing here.

I don’t have a large stake in Time, but I did purchase a TripsNFT which is a NFT project that used the treasury to purchase Time and rewards are then distributed to the NFT holders.

Frax Finance – FXS

If you have heard about the “Curve wars” this is why I’m investing here. (That’s for a whole other post). I’ve put a little into FXS and will keep reporting back more.

Free Crypto Holdings

Also included in this category are coins that I would receive free crypto. for example in Coin Market Caps earn programs or Coinbase learning for coin offerings.

I’ve had a handful of these coins that I received $3 (or less) in and are now worth over $50. With good growth and compounding it doesn’t take long.

When looking at the HODL investments I aim to seek profitable cash-flowing coins, infrastructure, or highly reputable projects that look good for the long wrong.

As always please DYOR – Do Your Own Research.