When I was in high school a new Xbox came out right around Christmas time.

I and a few friends camped out in front of Best Buy in freezing cold temps for two days, along with about 50 others to get the gaming system.

That same day the Xbox was selling for 5x on eBay.

This experience taught me a huge lesson on being early and limited supply economics.

Over the next few weeks as more Xbox’s were manufactured the price actually went below the retail price on secondary markets.

Today you can’t even give away an old Xbox as new and better products came to market.

So what does this have to do with finding new NFTs?

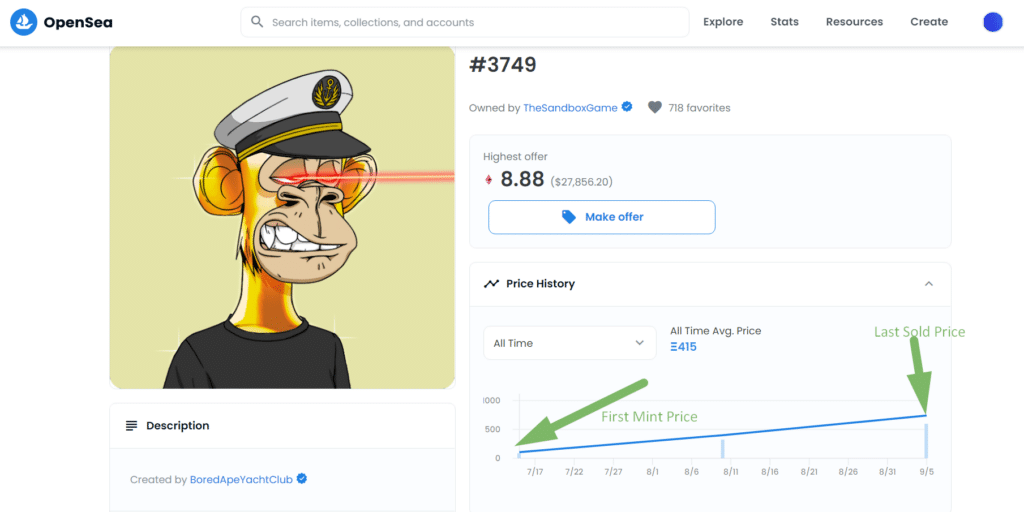

A new NFT project is announced with a limited supply. People then race to buy (similar to how people raced to buy the new Xbox)

The difference is that with the Xbox more can be produced.

With many NFT projects the quantity created is fixed, meaning no more can be created.

If an NFT has a great utility and people actually want it, the price can go from zero to millions of dollars.

If the project flops, or new more valuable products come to market you’ll be holding onto a worthless piece of code.

The moral of the story is if you want to be successful in finding new NFT projects you need to carefully research Supply and Demand.

In this post, we will talk about

Find New NFTs Before Everyone Else

There are a few options to lock down NFTs projects early.

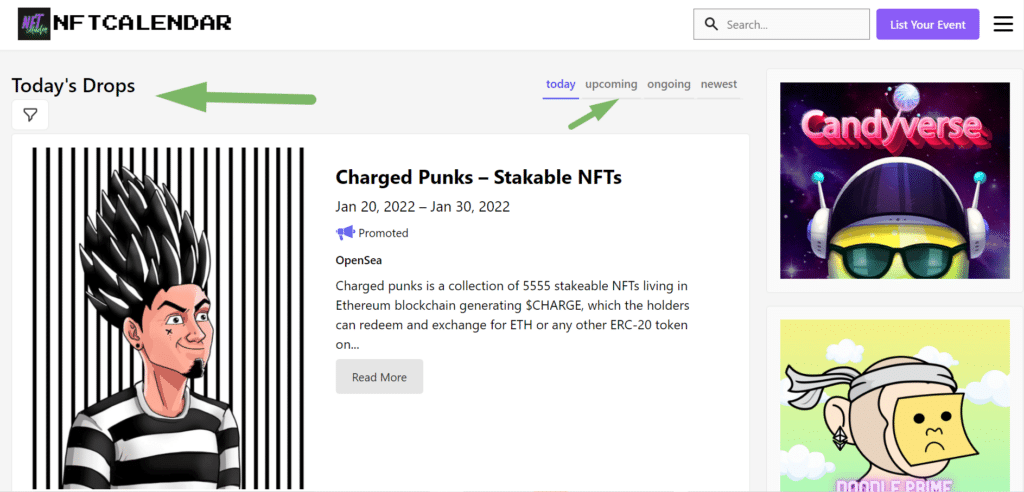

1.) Follow NFT calendars such as NFTCalendar

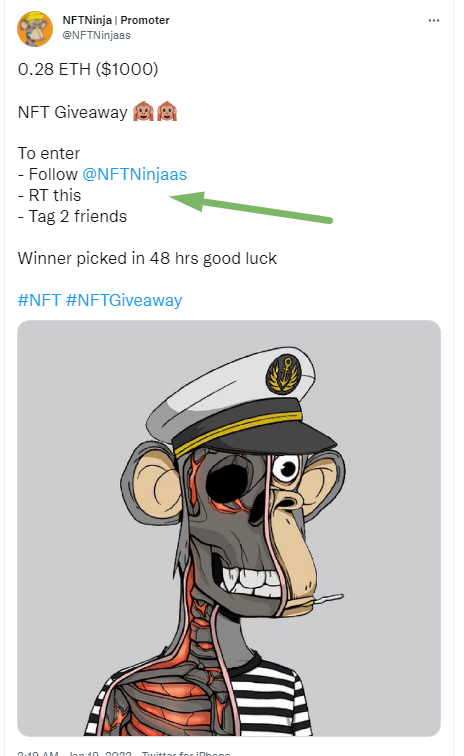

2.) Scour Twitter for new mints and whitelist opportunities.

3.) Search and sort secondary markets for new mints.

(#1 & #2) Following NFT Calendars and Twitter

Using NFT calendars and Twitter is probably your best bet if you have plenty of time.

There are hundreds of contests and opportunities to earn whitelist opportunities to jump to the front of the line to mint NFTs.

The problem is these take time and are a bit annoying.

They typically involve “tagging three friends”, “joining social channels”, and “retweeting” to gain exclusive access.

We do this on occasion, but they’re just not enough hours in the day, especially if you don’t know where the project is headed.

To find early projects Digital Farmland uses strategy number three.

By looking through recently minted and sold NFTs on marketplaces you can get a quick idea of what projects are trending.

The benefit here is you are looking at real sales data.

(#3) Looking at Marketplace Trends

What we do to identify new projects is look at what is selling in the marketplace. A somewhat quantifiable measure of time on market vs sales volume.

New Project + Increasing Sales = Review to see if we could get in on the project early

Existing Project + Large Gap between floor price and consistent sales = Review NFT to see if undervalued.

Much of this strategy we’ve outlined in our NFT Arbitrage strategy here.

Identifying Promosing Early Projects

So let’s say a project hits on our radar as a promising new project based on the increasing sales metric mentioned above.

(this strategy of reviewing a project will also work with existing projects, but since existing projects have more sales volume the sales have much more weight)

To determine if we think a project will be around long term, we’ll look for things like

- Strong Social Following

- Transparent Founders (do they share their identity, linkedin profile, social media, etc)

- Utiltiy and actual benefits of the NFT.

- Number of contract holders

- Locked Liquidity if gaming NFT (if a NFT game liquidity is extremely important for new games.)

- General Sentiment of project. We look to see if people are talking about the project and if so is it good things or bad things. (we’ve found people are more “forthcoming” in discord channels that are a bit more private than public twitter feeds.)

A lot of this is gut feel, but could also be quantified if you took the time to analyze.

Taking Risks on NFTs

With early projects, there will be a lot of duds and a few successes.

That’s where understanding how much you are willing to risk comes to play.

If an NFT is only a few dollars and has a limited quantity we’ll scoop it up.

If the NFT is a couple hundred the stronger the signals analyzed above need to be

With new NFT projects, you should treat them like the dot com boom. Just assume most will bust, but maybe a few will come out as huge successes.

Summary

The best way to get involved with NFTs and new projects is to just get started looking at the marketplaces.

Find an NFT you like and follow it over some time. You’ll start to see the price trends and growth.

As new projects emerge that are similar you’ll know what to expect.

Best of luck!