Have you heard of someone going to a local garage sale, finding a rare baseball card, and selling it for thousands of dollars more online or to a card collector?

It’s all about finding the right market to sell your item in.

A classic example of supply and demand.

With NFT Flipping you can create a similar arbitrage flipping strategy.

I recently bought a few NFT’s on tofunft.com a lesser-known NFT marketplace.

I then immediately took those NFTs and put them up for sale on nftrade.com a marketplace with a lot more traffic.

The floor price on ToFunNFT was drastically lower, providing an arbitrage opportunity.

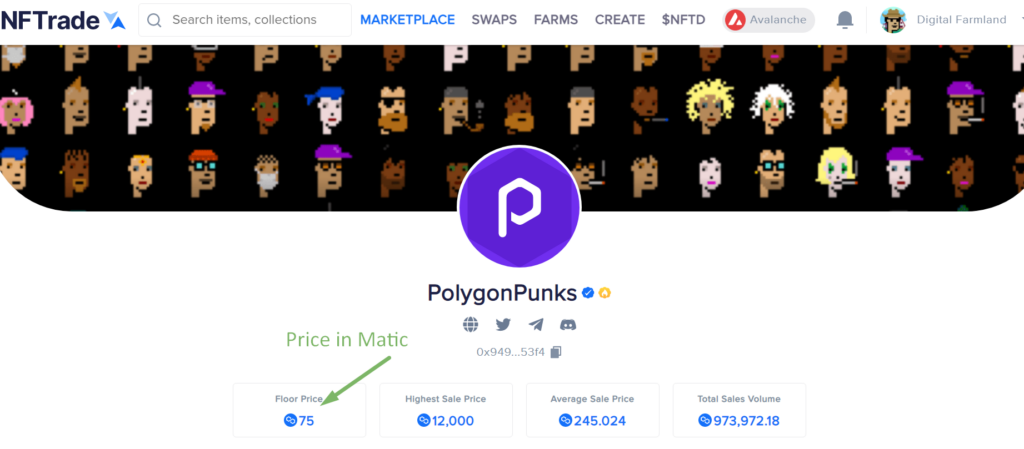

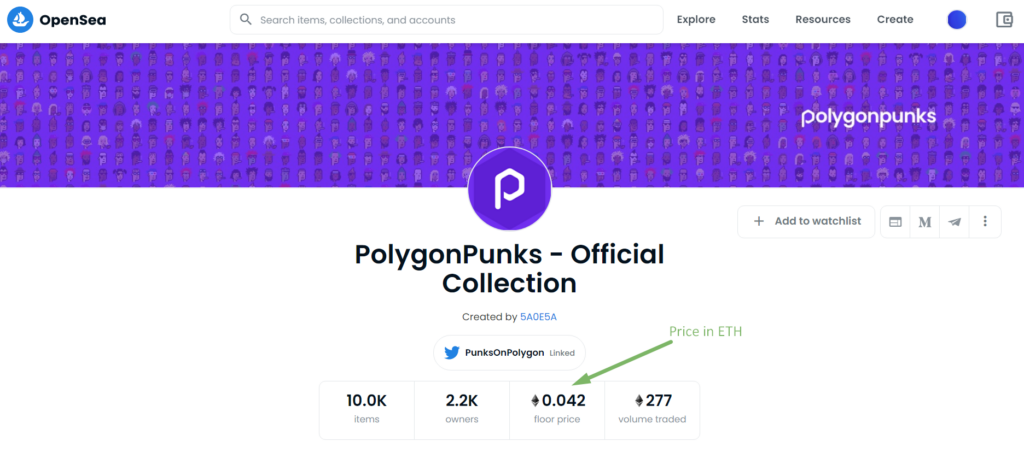

Here’s another example with PolygonPunks.

NFT Flipping Example

On NFTrade the floor price is 75 Matic.

On OpenSea the floor price is .042 eth.

and ToFuNFT floor price is 250 Matic.

If we convert the ETH to Matic for easy reference the breakdown for the cheapest PolygonPunk or floor price is as follows:

| Marketplace | PolygonPunk Floor Price (in Matic at current conversion rates) |

| NFTrade | 75 |

| Opensea | 62.93 Matic |

| ToFuNFT | 250 Matic |

In this example, ToFuNFT has very little sales and traction for this project, and since the floor price is higher than the rest, I simply ignore this one.

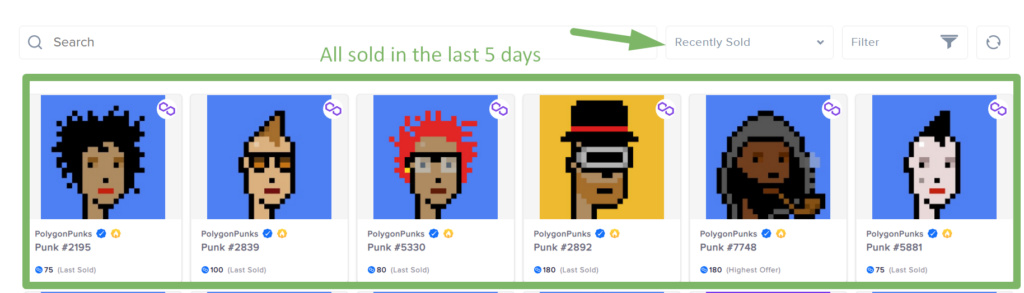

I then see that there are quite a few sales happening on NFTrade.

For example, all these PolygonPunks have sold in the last 5 days.

You could buy the floor price of approximately 62 Matic on Opensea and sell on NFTrade floor price of 75.

My hunch is it would take a day or two to sell and you would receive a profit of 13 Matic.

Floor Price NFT Flipping Strategy

My typical strategy is the idea of either raising the floor price or selling on the other market for a larger price.

Buying at the floor price is easier for me than trying to identify undervalued NFTs within a particular collection based on rarity.

If there is a demand for the NFT it can mean a quicker profit too.

It’s easier said than done a lot of research goes into it but if you have a little capital it’s a relatively low-risk way starting to flip NFTs.

Side note: my hunch is that there will be quite a few NFT Marketplace aggregators that will come into the market here shortly. For example, Orion Protocol is looking to do just that.

With new chains coming online and the fast pace of the NFT market even with these tools like Orion, there will be plenty of opportunities for arbitrage.

What to look at when flipping NFTs

These are the things we do for every NFT trade.

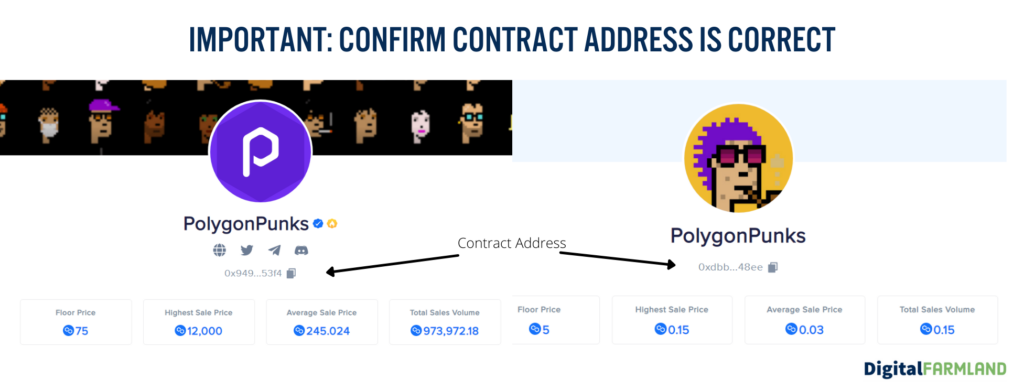

1. ) Confirm NFT Contract Address

Make absolutely sure the nft you are planning on Flipping is the correct contract address.

Many scammers create look-alikes that mimic popular digital art and digital asset projects. (i.e. similar to knock-offs replicas with physical goods.)

If you plan on purchasing from a lower lesser-known Marketplace be sure to verify that the contract address is the same across platforms.

Here is an example of a scam that looks very similar to the original project.

The only reason I can think that this was created was for the sole purpose of confusing the purchaser.

2.) Look for Trading Volume

For it to be a flipping opportunity people need to be actually buying the NFT you plan to flip.

I look for projects that have sold consistently about every couple of hours over a long period of time.

Stay clear of NFT collections that have sold a bunch very quickly, but haven’t sold any in months.

There are plenty of great projects that consistently sell NFTs every few days.

The more sales happen the more demand meaning you can flip quickly.

If NFTs are only selling every few days this means your capital is locked up for a longer period of time.

I aim to find NFT collections that are selling frequently about every few hours.

3.) Check Sales are REAL

Make sure those sales volumes in the previous step are actually real.

There have been a handful of scammers brought to light as they were buying their own NFT for 6 figures+, then an unsuspecting victim sees it is on sale for only 5 figures, they think they are getting a great deal.

When actually the scammer was only inflating the price.

4.) Find NFTs with Utility

This may be a personal preference as there are all sorts of NFT categories. But I look for NFT art with some sort of utility.

An example would be my TripsNFT which earns rewards as I hold it.

In the event that you end up holding longer than you had hoped due to liquidity issues or a poor assessment of demand in the marketplace. An NFT with utility will make holding less painful.

I’ve also purchased NFTs with the purpose of flipping but ended up keeping them instead as I liked it too much to part with it.

If your goal is profit, try not to fall in love!

5.) Check for KYC and Audits

KYC (know your customer) and contract audits are a simple way to see just how trustworthy an NFT collection is.

Projects that have been audited and the owners are showing transparency are typically more successful and less likely to be a rug pull.

There is still a lot of rug pulls even with an increase in transparency.

It’s not a catch-all.

Successful projects with owners who have remained anonymous and lack transparency turn out well too.

As a general rule of thumb, any NFT collection that is set up for the long term will have undergone audits were KYC measures.

(I would also include teams that say they plan on doing audits are a good start too, but use caution.)

6.) Identifying Worthwhile NFTs on Looks

While third-party verification is most important. I also l look at project design.

Yeah I know, don’t judge a book by it’s cover. but…

Things like do they have a well-designed or custom website, social media channels, a good following, or testimonials are all things to consider.

It takes a lot of time and energy to create a custom website and create a following. The more the owners are invested, the more likely the NFT project will be around years to come.

7.) Don’t spend more than you can afford to lose.

I’m sure you are tired of hearing this, but can’t say it enough.

Do your own research even if someone is saying it’s the best thing since sliced bread with beautiful artwork and screenshots on Twitter to back it up doesn’t mean it’s true.

Do not buy an NFT just because someone with a lot of followers said to do so.

If it feels like FOMO it probably is.

8.) Follow NFT Influencers

Contradicting to the previous statement, you should follow influencers on social media sites like Twitter to help you identify money flipping NFTs trending this will help you narrow down to the most popular projects quickly.

Additionally when looking to buy an NFT to flip projects that are backed by these influencers tend to do better as well.

Good luck with your NFT flipping. If you want to share your NFT flipping strategy or success on the Digital Farmland Podcast let us know!

Follow us on Twitter and join our email list for our up to date NFT trades and strategies!