THE “FARM”

Our Digital Property Investments, Holdings, and Strategy

The goal of Digital Farmland is to grow a portfolio of digital assets and investments for the long term. This means we’ll try to avoid “get rich quick schemes” and focus on digital assets we believe will be around for generations.

CRYPTO INVESTMENTS MADE TO DATE

Crypto “Mining”

-

Planet Watch

Planet Watch

-

Helium (HNT)

Helium (HNT)

-

GPU Mining

GPU Mining

NFTs & Gaming

Nodes & DAOS

INVESTMENTS

-

Long Term (HODL)

Long Term (HODL)

-

Liquidity Mining

Liquidity Mining

-

Colony Lab

CRYPTO INVESTMENT THESIS:

If you are familiar with the Pareto theory most commonly referred to as the 80/20 it states that 80% of outcomes are due to 20% of causes

I believe this to hold true in crypto.

When looking at the crypto landscape it’s easy to see how this could hold true.

Extreme crypto profit return outcomes represent a disproportionate amount of the share of returns.

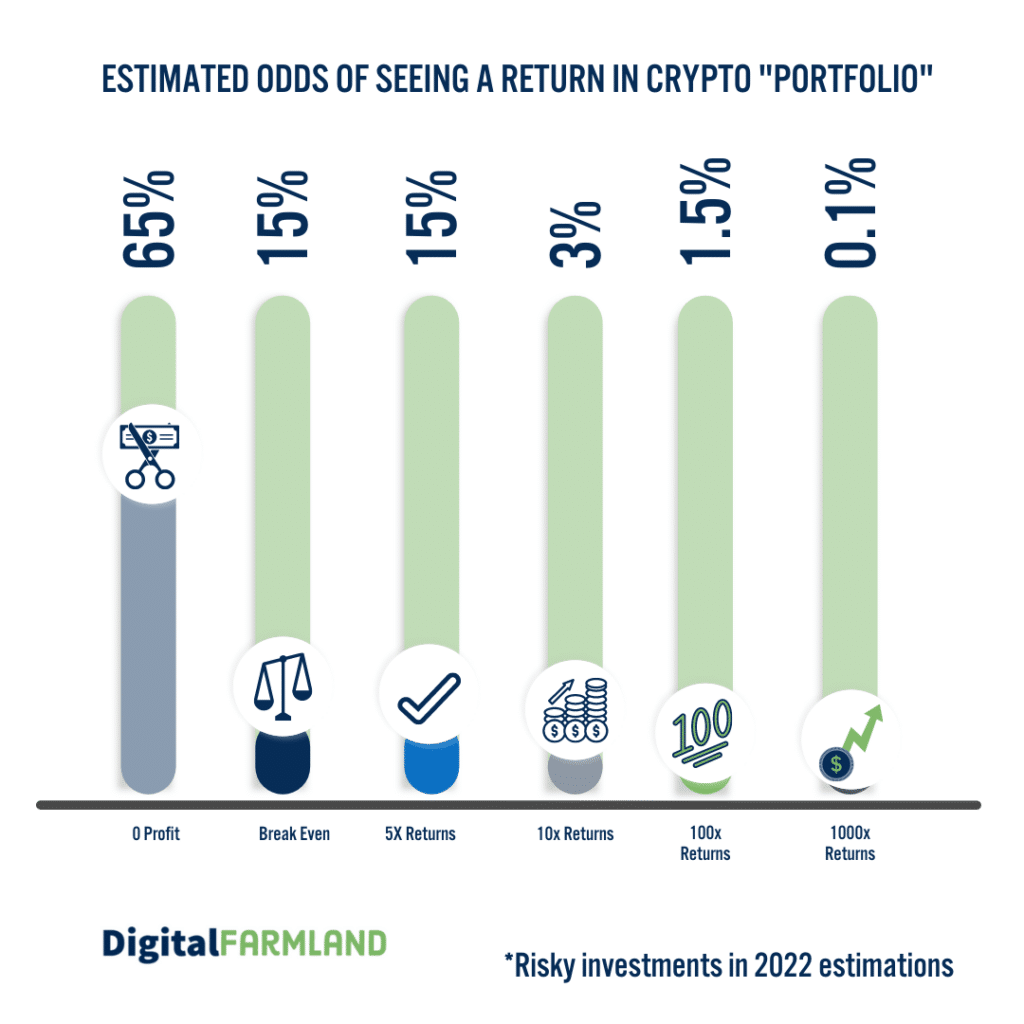

My assumption for crypto investment outcomes is based on limited data and ideas of my own, so take with a grain of salt.

65% FailuresThe coin, token, node, etc fails. Either from rug pull, regulatory concerns, or fear in the market. The investment gets $0 money returned.

15% Break EvenThe investment achieves some limited success, but no profit is generated and the money is returned.

15% Decent ReturnsThe crypto investment has success and the money returned is approximately 5x. For example a $100 investment turns to $500.

3% Solid ReturnsA Solid investment that generates a 10x return. These will be few and far between.

1.5% WindfallInvestments generating 100x returns would be considered a big success, and would be by any investment team.

0.5% Bumper CropIn agriculture, a Bumper Crop is a crop that has yielded an unusually productive harvest. It's a rare event, just like getting 1000x return. Think of this like investing in bitcoin when at $100 and exiting at current valuations. Or an early supporter of Dogecoin.

In other words, 80% will either fail or generate no revenue and 20% will be profitable.

With this distribution, you could compute an expected value of an investment.

0.65*0+0.15*1+0.15*3+0.03*10+0.015*100+0.005*1000 = 7.4

These estimates are mostly guesses.

There is no great data on whether or not .5% will turn into 1000x.

I arrived here using data from the Dot Com bubble.

For example, if you would have invested $5000 in 1997 Amazon IPO you would be worth over $2.4 million.

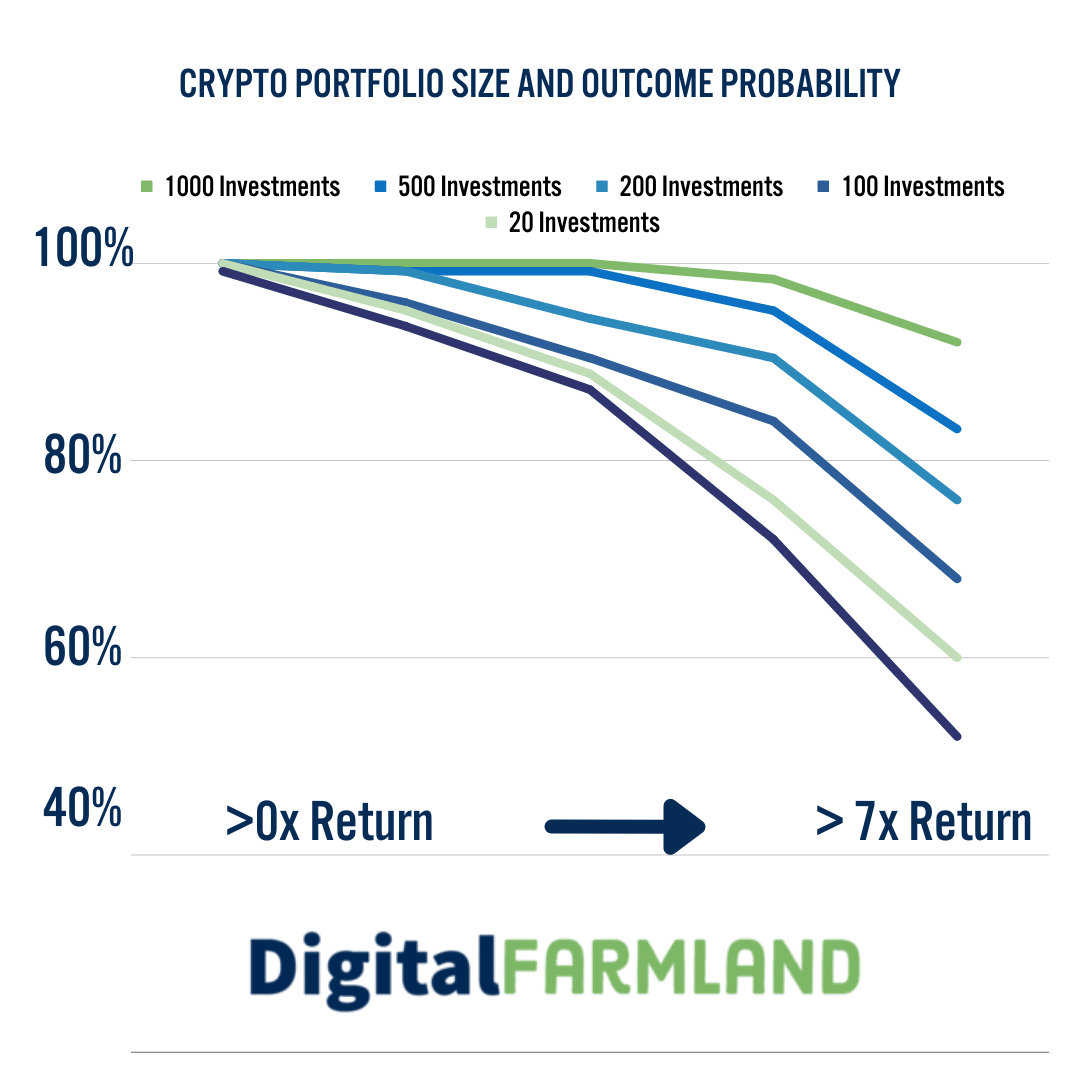

Using this type of methodology would mean that I need to invest in a lot of companies for a return.

Investing in 10 crypto opportunities the odds of getting even a typical market size return is incredibly low.

If you think you can forecast the future and are great picking projects your odds would obviously go up.

My thought is that even the brightest people lost money in the dot com boom and with blockchain technologies so new, I’m not going to pretend I can pick opportunities better than everyone else.

My goal is to invest in 104 Crypto Projects this year. (about 2 a week)

This should give me a decent chance of landing a “BUMPER CROP”.

Helium: details coming soon!

With PlanetWatch you can earn the crypto token $PLANETS for providing air quality data. Earnings = approximately $7 per day.

Details coming soon

Liquidity Mining: Details coming soon

We are actively investing in NFT projects that we believe will be around for years to come. From digital land, gaming, and DeFi NFts.

The Digital Farmland portfolio consists on numerous crypto currencies and tokens we plan to hold onto long term. In other words we are buying and holding on through the wild swings in hopes of long term growth.

Crypto Gaming: Strategy and info arriving shortly

IMPORTANT

None of the information you read on Digital Farmland should be taken as investment advice. Our content, writers, and journalists’ opinions are solely their own. Cryptocurrency is highly volatile, full of scams, and risky.

We do our best to bring to light potential scams and gauge the risk of digital asset investments. But we too have been scammed and part of rug pulls. Even projects with great intentions and transparency fail due to third-party scammers or regulatory pressures. Even with all the scams and risks we still very much believe in the future of this new digital world. Please be careful and do your own research!